Company formation

/registration services in Colombia

Entering the Colombian market and incorporating a company in our country is not a complex procedure, in which FTC is able to assist you.

FTC is expert on Corporate Law that can guide you through the process to incorporate/register/set up a company in Colombia.

Regardless the size of the organization or industry you operate in, FTC can help you to:

- Choosing the appropriate legal entity (i.e., the Simplified joint stock corporation, Joint stock corporation, limited liability corporation, branch, among others).

- Structuring the legal entity according to Colombian domestic rules but following your business interest.

- Determining how to fund Colombian’s operations i.e., by means of either capital investment v. debt v. payment of services, according to the Colombian Tax rules.

- Carrying out the legal procedure to incorporate the legal entity before the Colombian notary and/or Chamber of Commerce, as the case may be.

- Opening the bank account before a friendly bank for foreign investment.

Please, fill out the below and will respond as soon as possible:

Basic Guidelines for the Incorporation/registration of a SAS entity in Colombia

1. How to set up a company in Colombia?

Colombian Legal framework provides 7 types of corporate vehicles to incorporate in Colombia such as: Simplified Joint Stock Corporations (S.A.S.), Joint Stock Corporations (S.A.), Limited Liability Corporations, Collective Corporations, Simple Limited Partnerships, Partnerships Limited by Shares and Branches.

However, Simplified Joint Stock Corporations (S.A.S.) are the most used legal type by foreign and national investors. This is true, because S.A.S. entities constitutes a different legal entity from its shareholders and, therefore, shareholders are not, in principle, liable for the S.A.S.’ acts and contracts.

That said, the incorporation of a S.A.S. entity shall follow a legal procedure, which is not a complex procedure to walk through in Colombia.

2. What are the minimum legal requirements for the incorporation of a S.A.S. in Colombia?

- Have at least one shareholder, who can be either a foreign or national person or individual or corporation.

- Selection of the corporate name of the entity.

- Determination of the business purpose of the entity.

- Elaboration of the Bylaws of the entity.

- Appointing a Legal Representative.

- Register a business (tax) address.

- Determination of the Authorized and subscribed capital of the entity.

- Fill out the Tax Responsibilities form before the Chamber of Commerce.

Important note:

- Prior to register the entity before the Chamber of Commerce, it should be confirmed that the selected corporate name is available.

- The founding shareholder does not need to physically be in Colombia. This is, because the incorporation can be done by an attorney, in which case a Power of Attorney would be needed.

- There is neither a minimum authorized nor a subscribed capital required for the incorporation of the S.A.S. Nevertheless, the S.A.S. can be incorporated with a law subscribed capital i.e., USD$1.000 for instance.

- Be informed that the subscribed capital is subject to Registration Tax at 0,7% at the moment of the incorporation of the S.A.S. before the Chamber of Commerce.

3. What are the documents that the shareholder(s) must provide us for the incorporation of a S.A.S. in Colombia?

If the shareholder is an Individual

- Power of Attorney.

- Copy of the passport of the individual signing the Power of Attorney.

If the shareholder is an Corporation or Legal entity

- Power of Attorney.

- Copy of the passport of the individual signing the Power of Attorney.

- Certificate of Legal Existence and Legal Representation or Certificate of Good Standing or Incumbency.

If the document is not provided in Spanish, a sworn translation into Spanish shall accompanied it.

4. Timeline for the incorporation of the S.A.S. in Colombia:

Once the documents required have been provided by the shareholder(s), the incorporation of the S.A.S. takes at least one-business-day.

5. Tax Registration / Identification Number of the S.A.S.

Generally, the Chamber of Commerce carries out the procedure before the National Taxing Authority to assign the Tax Identification Number to the S.A.S.

Sometimes the Chamber of Commerce fails to carry out said procedure, in which case the attorney shall obtain the Tax Identification Number before the National Taxing Authority. This process may take up to 5 business days.

6. Opening a Bank account

Opening a Bank account is an independent procedure from the incorporation of the S.A.S.

That said, once the S.A.S. has been successfully incorporated, opening a bank account may take up to 5 business days – although this estimate time may vary depending on each bank-.

The minimum documents required for opening a bank account are the following: (i) Certificate of Legal Existence and Legal Representation of the S.A.S., (ii) initial balance sheet of the S.A.S., (iii) copy of the ID of the Legal Representative, (iv) Shareholder certification issued by an Accountant, and (v) beneficial ownership certification.

Common FAQs when registering a Legal Entity in Colombia:

The most frequent questions by foreign investors:

Can a foreign individual or corporation be a (sole) shareholder in Colombia?

Indeed. In Colombia, foreign investment is complete allowed, without any limitation. Therefore, there is no requirement to have a Colombian shareholder of a S.A.S..

Should the Legal Representative of the S.A.S. be a Colombian National and physically located in Colombia?

The Legal Representative can be either a Colombian National or a foreign person. Further, the legal representative shall not be physically located in Colombia.

However, from the practical perspective, it is advisable to have a Legal Representative to be physically located in Colombia, in order to deal with local and private authorities.

Please, be informed that tax returns of the S.A.S. shall be filed by using the e-signature of the Legal Representative. (Note: e-signature are only provided by the National Taxing Authority, once said person has registered himself/herself before the National Taxing Authority).

What are the legal implications of being appointed as Legal Representative?

The Legal Representative shall be deemed jointly and severally liable for the S.A.S.’ acts, contracts and tax returns, as he/she is regarded as administrator/manager of the company.

After the incorporation of the S.A.S., how can the S.A.S. hire personell?

After having incorporated the company and obtaining the Tax Identification Number, the company must be registered before the Labor Risk Administrator (ARL).

Further, the company must be registered before a Family Compensation Fund.

After having complete these registration process, the company will be able to hire employees, and register them before the Health Promoting Entity (EPS) for public health coverage. In this case, each employee has the right to choose their desired health entity, to which the company has to submit the required form.

Additionally, the employees must be registered before a pension fund, which is freely chosen by the employees.

It is important to determine the type of contractual relationship, namely, (i) on site work, (ii) remote work, (iii) hybrid work, (iv) management and trust employee and (v) type of salary, among others.

Labour aspects for foreign investment.

Key information on contracting in Colombia for foreign investors.

1. Common concepts of employment contracts

Remuneration or wages.

- Salary is the remuneration or payment that the worker receives in the employment contract as consideration for his services, and which is paid in monthly or biweekly periods. The salary must be paid for equal and overdue periods, in legal currency. The payment period for salaries cannot be longer than one month.

- Ordinary Salary: It is the basis of a worker’s remuneration and represents the fixed remuneration for their work (Up to 10 Current Legal Minimum Monthly Wages (“SMLMV”). In addition, social benefits such as bonuses, severance pay, interest on severance and vacations must be recognized.

- Integral Salary: Modality that includes both the ordinary salary and a benefit factor that compensates for social benefits. The integral salary must be equal to or greater than 10 SMLMV, plus a benefit factor that cannot be less than 30% of that amount.

Note: In labor matters, all months are considered as equal periods of 30 days and therefore the year of 360, therefore, the salary must be paid for equal periods which is the measure of 30 days for all months regardless of the calendar number of these.

Social Benefits.

- Mid-year bonus: It is equivalent to half a monthly salary proportional to what was worked in the first semester of each year, which must be paid no later than June 30 of the respective year. This concept is not applicable to employment contracts under the full salary modality.

- End-of-year bonus: It is equivalent to half a monthly salary proportional to what is worked in the second semester of each year, which must be paid no later than December 20 of the respective year. This concept is not applicable to employment contracts under the full salary modality.

- Redundancy payment: Payment of a salary per year or proportional salary made by the employer in favor of the employee and that constitutes a savings to a severance fund. Payment is due no later than February 14 of each year. This concept is not applicable to employment contracts under the full salary modality.

- Interest on redundancy payment: Payment that employers must make to their workers each year, equivalent to 12% of the total value of the severance pay or proportional to a fraction of a year. This concept is not applicable to employment contracts under the modality of integral salary.

- Transportation subsidy: Monthly payment made to workers who earn up to two legal monthly minimum wages in force and who must use the public transportation service to get to their place of work. (currently amounts to COP$200,000, approximately US$ 50 approx.). This concept is not applicable to employment contracts under the modality of integral salary.

- Endowments: Mandatory social benefit that employers must provide to their workers who earn up to two legal monthly minimum wages in force. It consists of the delivery of a pair of shoes and a change of work clothes, three times a year, for the employee to use in the performance of their duties. This concept is not applicable to employment contracts under the modality of integral salary.

- Vacations-Holidays: 15 working days for each year worked or proportional per fraction of a year. However, the employer may grant more vacation days as an after-work benefit.

Labour shift.

- Currently, the maximum weekly labour shift corresponds to 44 hours. As of July 15th, 2026, the maximum weekly labor shift will be 42 hours.

- The maximum labour shift may be distributed between the employee and the employer during the 5 to 6 days a week, guaranteeing the day of rest.

- Generally, the maximum labour shift per day is 8 hours.

- However, as an exception, the employer and employee may agree that the maximum labor shift per day is carried out in flexible daily working hours distributed over a maximum of 6 days a week, having a minimum of 4 continuous hours and a maximum of up to 9 hours a day without any surcharge for additional work, provided that it does not exceed the maximum working day legally established.

- Currently, the daytime shift begins at 6:00 a.m. and ends at 9:00 p.m. and the nighttime shift begins at 9:00 p.m. and ends at 6:00 a.m. However, as of December 25, 2025, the daytime shift will begin at 6:00 a.m. and end at 7:00 p.m. and the nighttime shift will be from 7:00 p.m. to 6:00 a.m.

Mandatory rest or on a holiday.

- The mandatory or “Sunday” day of rest can be agreed between the company and the employee so that it is any day of the week, without necessarily coinciding with Sunday. If the parties do not agree, it will be presumed that the mandatory day of rest is Sunday.

- Work on mandatory rest days, or holidays, is remunerated with a surcharge of (i) 80%, (ii) 90% as of July 1st, 2026, and (iii) 100% as of July 1st, 2027, settled on the salary. The employer can adopt the 100% surcharge before July 1st, 2026.

- Work on a day of rest will be occasional when working up to 2 days of mandatory rest, during the calendar month. In this case, the employer will only pay the surcharge.

- Work on a day of rest will be usual when 3 or more days of mandatory rest are worked during the calendar month. In this case, the employer will have to (i) pay the surcharge and (ii) grant a paid day of rest for each day of work on a day of rest in the following week.

- Colombia has approximately 15 to 18 public holidays per year.

Surcharge for overtime pay, mandatory or "Sunday" rest days or holidays.

- Daytime overtime: Surcharge of 25% hour worked.

- Night overtime: Surcharge of 35% hour worked.

- Surcharge for work on mandatory or Sunday rest days and/or holidays:

100% applied on each hour worked. It can be implemented gradually like this:

- From July 1st, 2025: 80%.

As of July 1st, 2026: 90%.

From July 1st, 2027: 100%.

Note: The employer will be able to accept the 100% surcharge as of June 25, 2025.

Surcharge for overtime pay, mandatory or "Sunday" rest days or holidays.

- Daytime overtime: Surcharge of 25% hour worked.

- Night overtime: Surcharge of 35% hour worked.

- Surcharge for work on mandatory or Sunday rest days and/or holidays:

100% applied on each hour worked. It can be implemented gradually like this:

- From July 1st, 2025: 80%.

As of July 1st, 2026: 90%.

From July 1st, 2027: 100%.

Note: The employer will be able to accept the 100% surcharge as of June 25, 2025.

- Surcharge of the extra daytime lora on mandatory rest day/public holiday: 80%/90%/100% + 25% hour worked.

- Surcharge for night overtime mandatory rest day/holiday: 80%/90%/100% + 35% hour worked.

- Overtime cannot exceed 2 hours per day or 12 hours per week.

- Prior authorization or permission from the Ministry of Labor is not required to work overtime.

- “Direction, trust and management” positions are not eligible for overtime or surcharges, except for the night shift surcharge.

Work disconnection.

- Workers have the right not to be contacted for work matters outside of their working hours, vacations or breaks.

Compulsory and paid leave.

- Performance of temporary official positions of compulsory acceptance.

- Serious case of duly proven domestic calamity.

Note: A serious case of calamity is understood as any personal or family event up to the third degree of consanguinity, second affinity or first civil degree, fortuitous event or force majeure whose seriousness affects the normal development of the worker’s activities.

- To hold union committees, provided that due notice is given, and that the number of absentees does not prejudice the normal functioning of the company.

- Attend emergency medical appointments or scheduled medical appointments with specialists when informed to the employer along with the prior certificate, including the diagnosis and treatment of endometriosis.

- Attend school obligations as an attendant in which the assistant is mandatory at the request of the educational center.

- Respond to judicial, administrative, and legal summonses.

- Maternity leave: All pregnant workers are entitled to 18 weeks of leave at the time of childbirth, paid with the salary earned at the time of starting their leave.

- Paternity leave: Paid leave of two weeks that benefits the worker who is a father contributing to the social security system, for the children born to the spouse or permanent partner.

- Shared Parental Leave: Allows employed fathers to distribute the last 6 weeks of maternity leave among themselves. The mother must enjoy at least the first 12 weeks after childbirth, and the remaining 6 weeks can be shared with the father, by mutual agreement.

- Flexible part-time parental leave: Allows employed fathers to agree with the company to exchange part of their maternity or paternity leave for a period of part-time work. This means they can work part-time and spend the other half of the time caring for the baby, extending the total length of leave.

- Bereavement leave: Period granted to the worker for 5 paid working days when any of the people who have the following types of relationship with the worker dies: (i) Spouse or permanent partner, (ii) Relative up to the second degree of consanguinity, (iii) Parents, children, grandparents, grandchildren, siblings, (iv) Relative up to the first degree of affinity – parents-in-law and stepchildren and (v) Relative up to the first civil degree – adopted child, adoptive parents.

- Other licenses:

- Performance of temporary official positions of compulsory acceptance

- Serious case of duly proven domestic calamity.

Note: Serious case of calamity understood as any personal, family event up to the third degree of consanguinity, second affinity or first civil, fortuitous event or force majeure whose seriousness affects the normal development of the worker’s activities.

- To hold union committees, provided that the employee gives due notice, and that the number of absentees does not prejudice the normal functioning of the company

- Attend emergency medical appointments or scheduled medical appointments with specialists when the employer is informed along with the prior certificate, including the diagnosis and treatment of endometriosis

- Attend school obligations as an attendee in which the assistant is mandatory at the request of the educational center

- Respond to judicial, administrative, and legal summonses.

Vacation.

- 15 working days for each year worked or proportional per fraction of a year. However, the employer may grant more vacation days as an after-work benefit.

2. Employment contracts.

Types of Employment Contracts.

- General rule: Indefinite term contracts

- Exceptions:

- Fixed-term contract:

- Maximum term of four (4) years.

- It must be in writing.

- If it does not comply with the above conditions, it will be understood that it is an indefinite term contract from the date of its conclusion.

- Nor it may be renewed indefinitely, however the parties may consider the following extensions:

- Agreed extension:

- Contract entered into for a term of less than one year, may be extended as many times as they deem appropriate.

- But after the 4th extension it may not be renewed for a period of less than one year.

- Automatic extension:

- If, 30 days prior to the expiration of the agreed term or its extension, neither of the parties expresses its intention to terminate the contract, the contract will be understood to be renewed for a term equal to the one initially agreed or its extension, as the case may be.

- The maximum limit of 4 years provided for may not be exceeded.

- This rule will apply to contracts entered into for a term of less than one year, but in this case the fourth automatic extension will be for a period of one year.

- Fixed-term contract:

Probationary period.

- For indefinite-term contracts: 2 months.

- For fixed-term contracts: 20% of the term, not exceeding 2 months.

- For term contracts for the duration of work: 2 months.

Notice of termination of contract.

- For indefinite term contracts:

- Just cause: No notice period or with a period of 15 working days, depending on the cause of the termination.

- No just cause: No notice period.

- Fixed-term contracts.

- Automatic extension contracts: 30 days before the expiry of the agreed term or its extension, otherwise it will be understood to be automatically renewed.

- For just cause: No notice period or with a period of 15 working days, depending on the cause of the termination.

- Without just cause: No notice period.

- Duration of the work: When the work is finished.

Severance payment.

- Indefinite term:

- 10 current legal monthly minimum wages (“SMLMV”): 30 days’ salary in the first year + 20 days’ salary in the following years (proportionally for each year).

- + 10 SMLMV: 20 days’ salary for the first year + 15 days’ salary for the following years (proportionally for each year).

- Fixed Term: The value of the salary for the remaining time of the contract.

- Duration of Work:

- Estimated wages remaining until completion of the job.

- Payment may not be less than 15 business days.

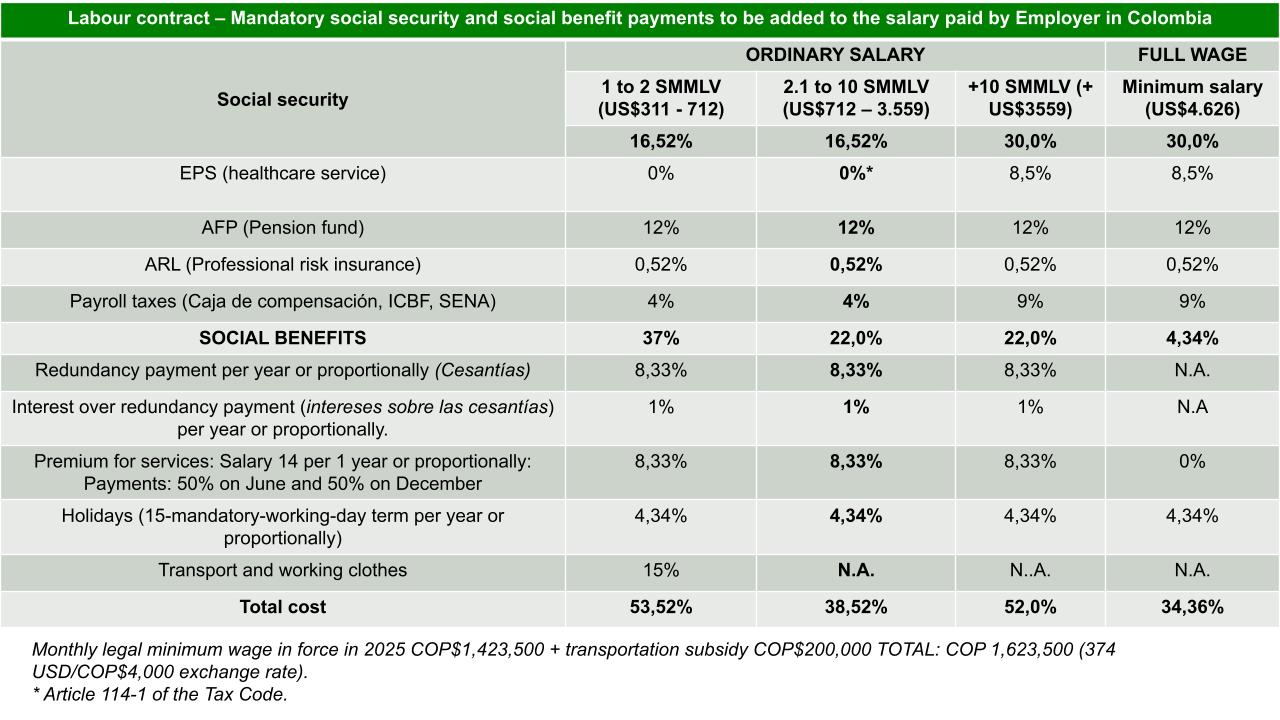

3. Labour contract – Mandatory social security payments to be added to the salary.

Our Company formation services

FTC provides the following services in order to expand your business activities in Colombia